Federal Tax Brackets 2025 Mfj. The next portion of income, which is. Below are the tax brackets for 2025 taxable income.

If you don’t want to miss on the the tax credits, deductions, and benefits available, consult tax accountant surrey for a professional opinion. See current federal tax brackets and rates based on your income and filing status. 2025 and 2025 tax brackets and federal income tax rates.

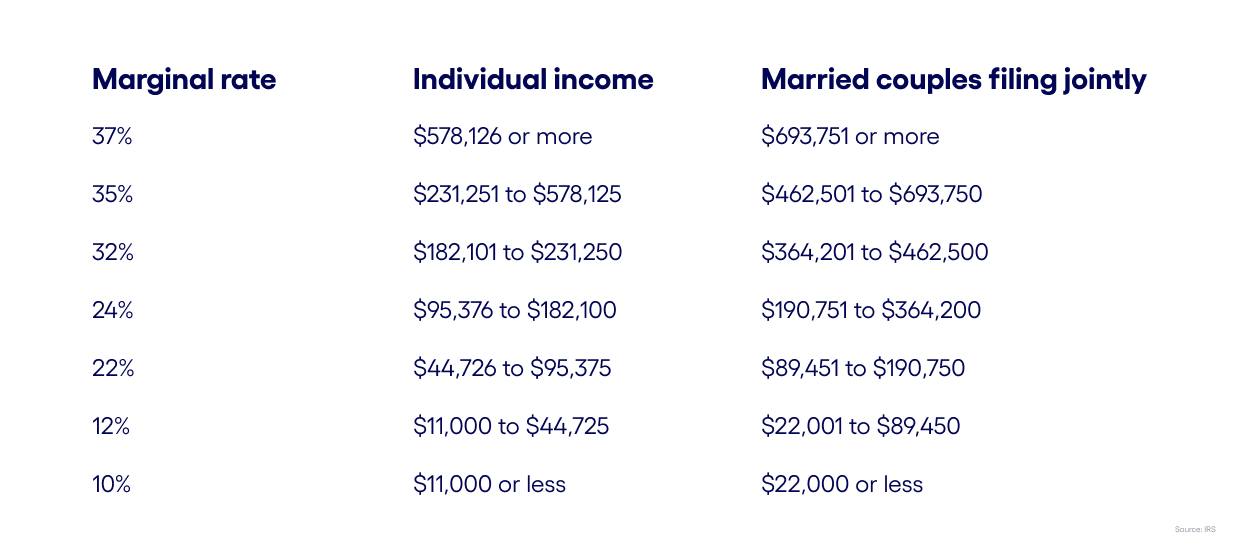

Most taxpayers pay a maximum 15% rate, but a 20% tax rate applies to the. The federal income tax has seven tax rates in 2025:

Here are the federal tax brackets for 2025 vs. 2025 People's Investor, The rate of social security tax on taxable wages is 6.2% each for the employer and employee.

Tax filers can keep more money in 2025 as IRS shifts brackets Andrews, Your income each year determines which federal tax bracket you fall into and which of the seven income tax.

2025 and 2025 Federal Tax Brackets and Tax Rates Kiplinger, For tax year 2025, the top marginal tax rate remains 37%.

What Tax Bracket Am I In Here S How To Find Out Business Insider Africa, 10 percent, 12 percent, 22 percent, 24.

2025 Federal Tax Brackets 2025, Capital gains rates will not change in 2025, but the brackets for the rates will change.

How The 2025 Tax Brackets Can Affect Your Business Bluevine, 10 percent, 12 percent, 22 percent, 24.

What Are The Tax Brackets For 2025 Married Filing Jointly Printable, You will also find guidelines for calculating your income tax based.

2025 Tax Rate Tables Printable Forms Free Online, See current federal tax brackets and rates based on your income and filing status.

The 2025 Tax Brackets By Modern Husbands Free Nude Porn Photos, The standard deduction for single.

2025 Federal Tax Brackets And Standard Deduction Printable Form, Download data 2025 tax brackets 2025 tax brackets on a yearly basis the internal revenue service (irs) adjusts more than 60 tax provisions for inflation to.

The rate of social security tax on taxable wages is 6.2% each for the employer and employee. To help you figure out how much you can expect to pay, here are the tax brackets for both the 2025 and 2025 tax years.

Enter the amount figured in step 1, earlier, as the total taxable wages on line 1a of the withholding worksheet that you use to figure federal income tax withholding.